Facultative Reinsurance Solutions

Tailored Coverage for Specific Risks

Facultative Reinsurance Service

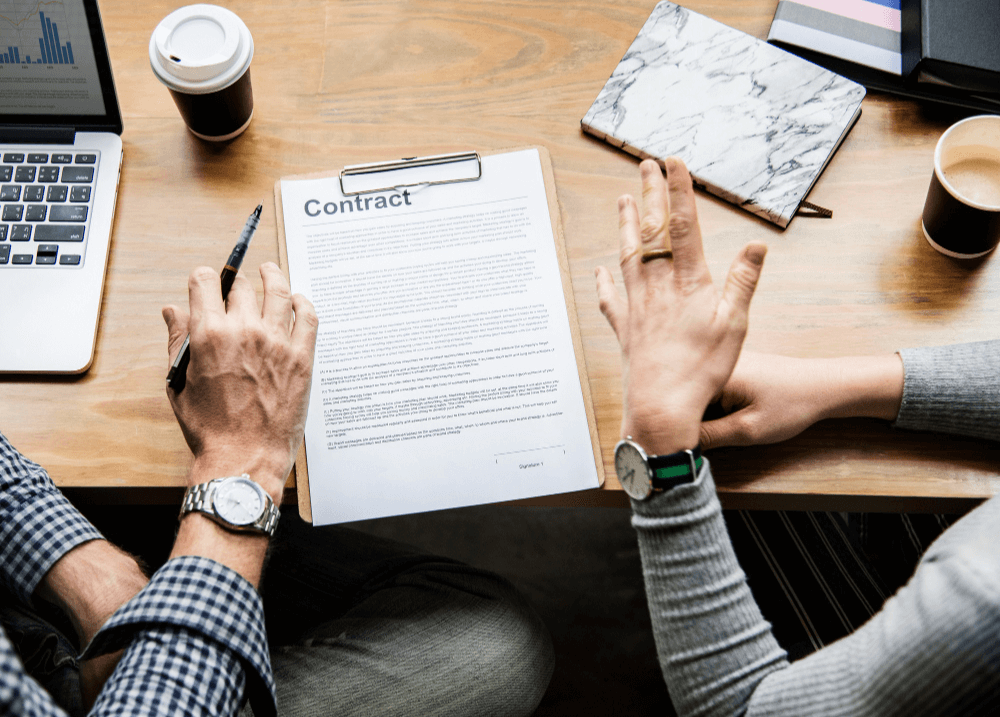

Through our Facultative Reinsurance Service, we at L&G Insruance offer tailored risk management solutions designed to meet the specific needs of individual insurance contracts or group policies. By providing a tailored coverage, we enable insurers to transfer particular risks that may exceed their retention limits or fall outside their usual underwriting guidelines and safeguard their interests. This flexibility allows our clients to manage their portfolios more effectively and with greater confidence.

This approach and solution is driven with a deep understanding of the complexities and unique challenges in the reinsurance market. Our expert team delivers customised facultative reinsurance agreements that enhance financial stability and support long-term growth of our customers. Our commitment to personalized service ensures that each client’s specific risk profile is addressed, offering peace of mind and robust protection against unforeseen events.

What is Facultative Reinsurance?

Facultative reinsurance is a type of reinsurance policy where an insurance holder seeks coverage for individual or specific risks, rather than surrendering a portion of his or her entire portfolio. This form of reinsurance is negotiated separately for each risk, allowing for tailored solutions that address particular exposures. It is a flexible and customizable approach, enabling insurers to manage specific, often larger or more complex, risks that exceed their normal capacity.

Key Features

Coverage for Individual or Specific Risks

Facultative reinsurance focuses on individual risks, providing customised coverage for particular policies. This allows insurers to obtain protection on a case-by-case basis which helps match their specific needs.

One-Time Contracts Tailored to Specific Needs

Each facultative reinsurance agreement is a one-time contract, crafted with detail to meet the unique requirements of the specific risk it covers. This personalised approach ensures precise alignment with the insurer’s needs and risk profile.

When to Use

Facultative reinsurance is ideal in several scenarios such as:

High-Value or High-Risk Policies

When an insurer faces an unusually large or hazardous risk that surpasses its retention limits, facultative reinsurance provides the necessary coverage to manage these exposures.

Unique or Complex Risks

For risks that are atypical or particularly complex, and may not fit within the parameters of the insurer’s standard policies, facultative reinsurance offers a customized solution.

Supplemental

Coverage

Insurers may also use facultative reinsurance to supplement their existing treaty reinsurance, whcih helps procide additional capacity for specific risks that require extra attention.

New or Emerging

Risks

When dealing with new or emerging risks that the insurer has limited experience with, facultative reinsurance can offer a way to mitigate these uncertainties effectively.

Benefits of Facultative Reinsurance

Customized Coverage

Facultative reinsurance provides tailored solutions for specific risks that may not be adequately covered by standard insurance policies. This customisation ensures that each reinsurance agreement is completely addressing the unique characteristics and needs of the individual risk. This offers more precise and effective coverage to the risk taking individual. By focusing on particular exposures, insurers can achieve a higher degree of protection for non-standard or complex risks.

Risk Mitigation

One of the primary benefits of facultative reinsurance is its ability to help insurers manage large or unique risks. By transferring these specific risks to a reinsurer, insurers can stabilize their financial performance and protect themselves from significant losses incase of emergencies. This risk mitigation is crucial for maintaining solvency and ensuring long-term viability, especially when dealing with high-value or hazardous policies.

Flexibility

Facultative reinsurance offers significant flexibility in negotiating terms and conditions. Each contract is crafted individually, allowing insurers to define the coverage parameters, limits, and premiums that best suit their needs. This flexibility extends to the choice of risks to be reinsured and the ability to obtain protection on a case-by-case basis, providing a versatile tool for effective risk management.

How Facultative Reinsurance Works

Process Overview: Let us take a look at the process of how facultative reinsurance works

Identification of Risk

The primary insurer identifies a specific risk or a policy that exceeds its retention capacity or falls outside its typical must-be-follwed guidelines.

Assessment and Proposal

The insurer assesses the risk and prepares a detailed proposal, including relevant information such as the nature of the risk, coverage amount, and terms. This proposal is then presented to potential reinsurers for assessment purposes.

Negotiation

The insurer and the reinsurer engage in negotiations to agree on the terms, conditions, coverage limits, and premium for the facultative reinsurance contract. This step may involve multiple rounds of discussions to ensure both parties’ requirements are met.

Underwriting

The reinsurer conducts a thorough underwriting process, evaluating the risk and determining the appropriate coverage and premium for the reinsurance policy. This may involve reviewing detailed documentation and risk assessments provided by the primary insurer.

Agreement and Documentation

Once the terms are agreed upon, a facultative reinsurance agreement is drafted and signed by both parties. This document outlines all the specifics of the coverage, including exclusions, limits, and obligations.

Coverage Commencement

The reinsurance coverage begins as specified in the contract, providing the primary insurer with the agreed-upon protection for the identified risk of the policy or undertaking.

Example Scenario

Imagine an insurance company is asked to insure a large corporate building valued at Rs 50 lakhs. This building poses a higher risk than the insurer is comfortable retaining. Here’s how facultative reinsurance might work in this scenario:

- Identification of Risk: The insurer recognizes that insuring the entire 50 lakhs building is beyond its retention limit.

- Assessment and Proposal: The insurer then compiles detailed information about the building, including its location, construction materials, fire protection measures, and usage. The insurer then creates a proposal outlining the desired coverage and terms for reinsurance.

- Negotiation: The insurer submits the proposal to several reinsurers. After reviewing the details, a reinsurer offers terms, including a premium and specific conditions for covering the building.

- Underwriting: The reinsurer will now conduct its own assessment, possibly including a site visit and review of safety reports, before finalizing the terms.

- Agreement and Documentation: Both parties agree on the terms, and a facultative reinsurance contract is drawn up. This contract details the coverage for the corporate building, including any exclusions or specific conditions.

- Coverage Commencement: Once the contract is signed, the coverage starts, providing the insurer with reinsurance protection for the corporate building.

Documentation

The necessary documentation and data required for facultative reinsurance typically include the following:

Detailed Risk Description

Comprehensive details about the risk to be reinsured, such as property characteristics, usage, and value.

Types of Facultative Reinsurance

Proportional Facultative Reinsurance

- Definition and Details:

Proportional facultative reinsurance, also known as pro rata reinsurance, is a type of reinsurance that involves sharing the risk and premium on a proportional basis between the primary insurer and the reinsurer. Under this type of an arrangement, the reinsurer agrees to accept a predetermined percentage of each insurance policy issued by the primary insurer. Then the reinsurer corresponds to the same percentage of premiums and losses that have been agreed upon. This type of reinsurance is often used for specific risks or policies that exceed the insurer’s capacity but still require proportional risk-sharing.

- Benefits and Use Cases:

Risk Sharing: Proportional facultative reinsurance allows the primary insurer to share the risk and premium income with the reinsurer, reducing its risk of large or unexpected losses.

Capacity Enhancement: Insurers can increase their underwriting capacity by ceding a portion of the risk to reinsurers, thereby enabling them to write more business without compromising their financial stability.

Stabilization of Results: By spreading the risk across multiple parties, proportional facultative reinsurance helps stabilize the insurer’s financial results, particularly in disturbing or catastrophe-prone lines of business.

Non-Proportional Facultative Reinsurance

- Definition and Details:

Non-proportional facultative reinsurance, which is also referred to as excess of loss reinsurance, is a type of reinsurance arrangement designed to provide coverage for individual risks that surpass a pre-defined threshold. This threshold could be defined in terms of a specific loss amount or policy limit. In contrast to proportional reinsurance, where risk and premium are shared proportionally between the ceding insurer and the reinsurer, non-proportional reinsurance only comes into play when the losses exceed the agreed-upon threshold for the original insurer.

Non-proportional reinsurance arrangements are frequently utilized as a safeguard against catastrophic or highly severe events, offering protection when the losses surpass a certain threshold. This type of reinsurance provides an additional layer of security for the insurer, especially in situations where the potential losses may be substantial or difficult to predict.

- Benefits and Use Cases:

Catastrophic Protection: Non-proportional facultative reinsurance offers insurers protection against catastrophic losses that exceed their retention limits, providing a financial safety net for cases of extreme events.

Tailored Coverage: With the help of the tailored coverage feature, insurers can customize the coverage limits and deductibles of non-proportional reinsurance contracts to match their risk tolerance and exposure levels.

Capital Management: Through capital management, insurers can transfer the risk of large losses to reinsurers. This helps insurers optimise their capital and preserve financial stability, ensuring they can meet their obligations in the event of significant claims.

These two types of facultative reinsurance provide insurers with flexible options to manage specific risks and enhance their overall risk management strategies.

Why Choose LNG Insurance for Facultative Reinsurance?

There are many reasons to choose LNG for facultative Reinsurance and understanding how to go ahead with choosing the right insurance.

Expertise

LNG Insurance has extensive experience and expertise in facultative reinsurance. Driven by a team of seasoned professionals dedicated to providing outstanding service and support. Our experts also possess in-depth knowledge of the reinsurance market, enabling us to navigate complexities and deliver relevant solutions tailored to our client’s specific needs.

Client Success Stories

Our track record talks volumes about our commitment to excellence in facultative reinsurance. Through a series of successful case studies available on our website, we demonstrate our ability to address diverse challenges and deliver tangible results for our clients. From mitigating fateful risks to enhancing underwriting capacity, our innovative solutions have consistently exceeded expectations and ensured our clients’ long-term success.

Tailored Solutions

At LNG Insurance, we understand that one size does not fit all when it comes to reinsurance. That’s why we are dedicated to providing customized and effective solutions that address the unique risk profiles and objectives of each client. From comprehensive risk assessments to tailored coverage options, we work closely with our clients to develop strategies that maximize protection and optimize outcomes.

With LNG Insurance, you can trust that your facultative reinsurance needs are in capable hands. Our expertise, client-centric approach, and proven track record make us the partner of choice for navigating the complexities of reinsurance and achieving sustainable success.

Frequently Asked Questions (FAQs)

1. What is Facultative Reinsurance?

Facultative reinsurance is a type of reinsurance where risks are individually underwritten and reinsured on a case-by-case basis. It provides coverage for specific risks that may exceed an insurer’s capacity or fall outside its standard underwriting guidelines.

2. How does Facultative Reinsurance differ from Treaty Reinsurance?

Facultative reinsurance is negotiated separately for each risk, while treaty reinsurance involves a pre-established agreement covering a portfolio of risks. Treaty reinsurance typically provides automatic coverage for all risks within predefined parameters, whereas facultative reinsurance is tailored to individual risks.

3. What are the benefits of Facultative Reinsurance?

The benefits of facultative reinsurance include customized coverage for specific risks, risk mitigation for large or unique exposures, flexibility in negotiating terms and conditions, and enhanced underwriting capacity.

4. How do I know if Facultative Reinsurance is right for my business?

Facultative reinsurance may be suitable for your business if you encounter risks that exceed your retention limits, fall outside your standard underwriting guidelines, or require specialized coverage. It is particularly beneficial for managing high-value or complex risks that warrant individual attention and tailored solutions.

These FAQs provide a basic understanding of facultative reinsurance and its potential benefits for businesses seeking to manage and mitigate risk effectively. For more detailed information or assistance, feel free to reach out to our team at LNG Insurance.